06 Dec 2025 Reading time: 1 minute

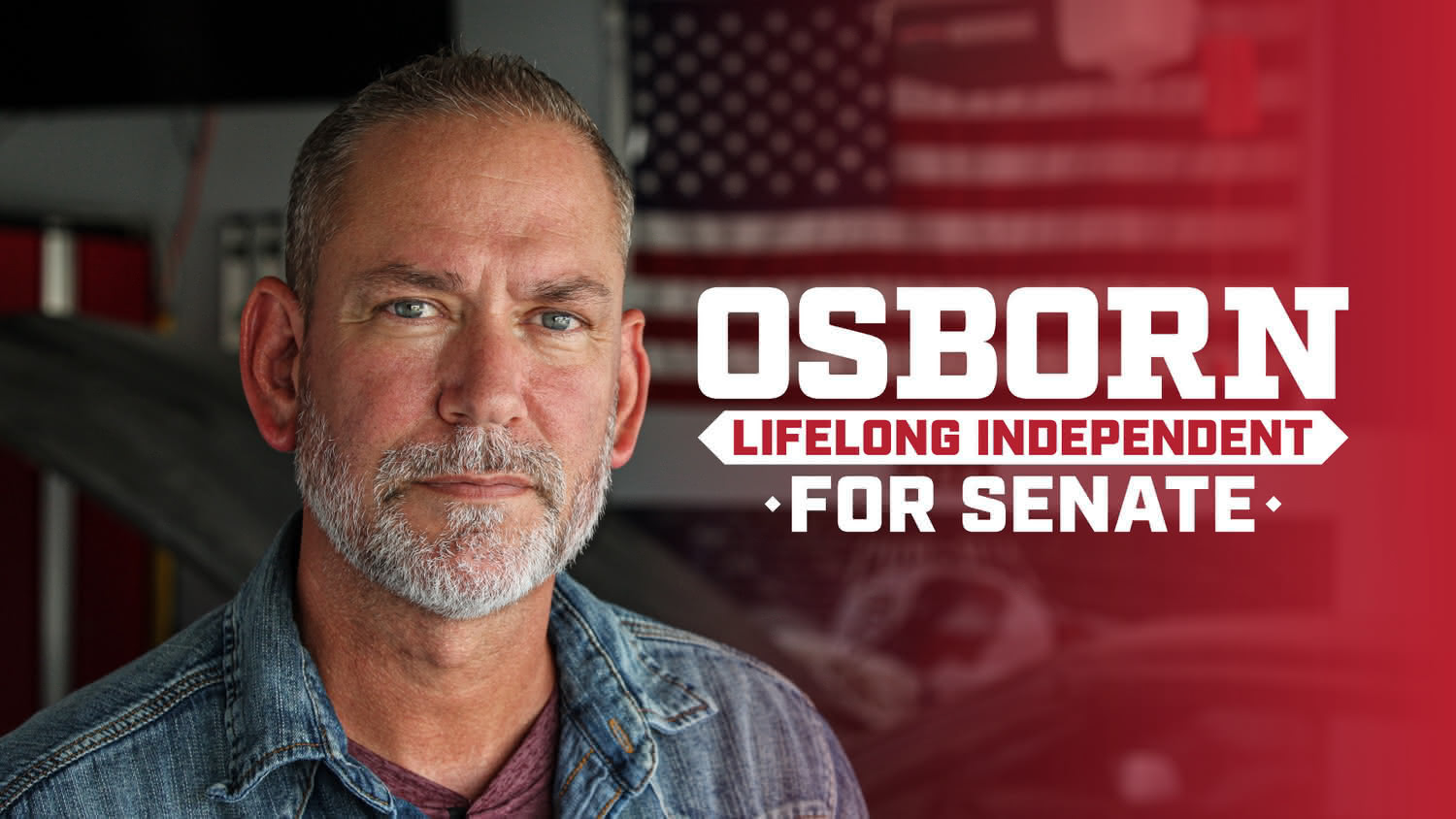

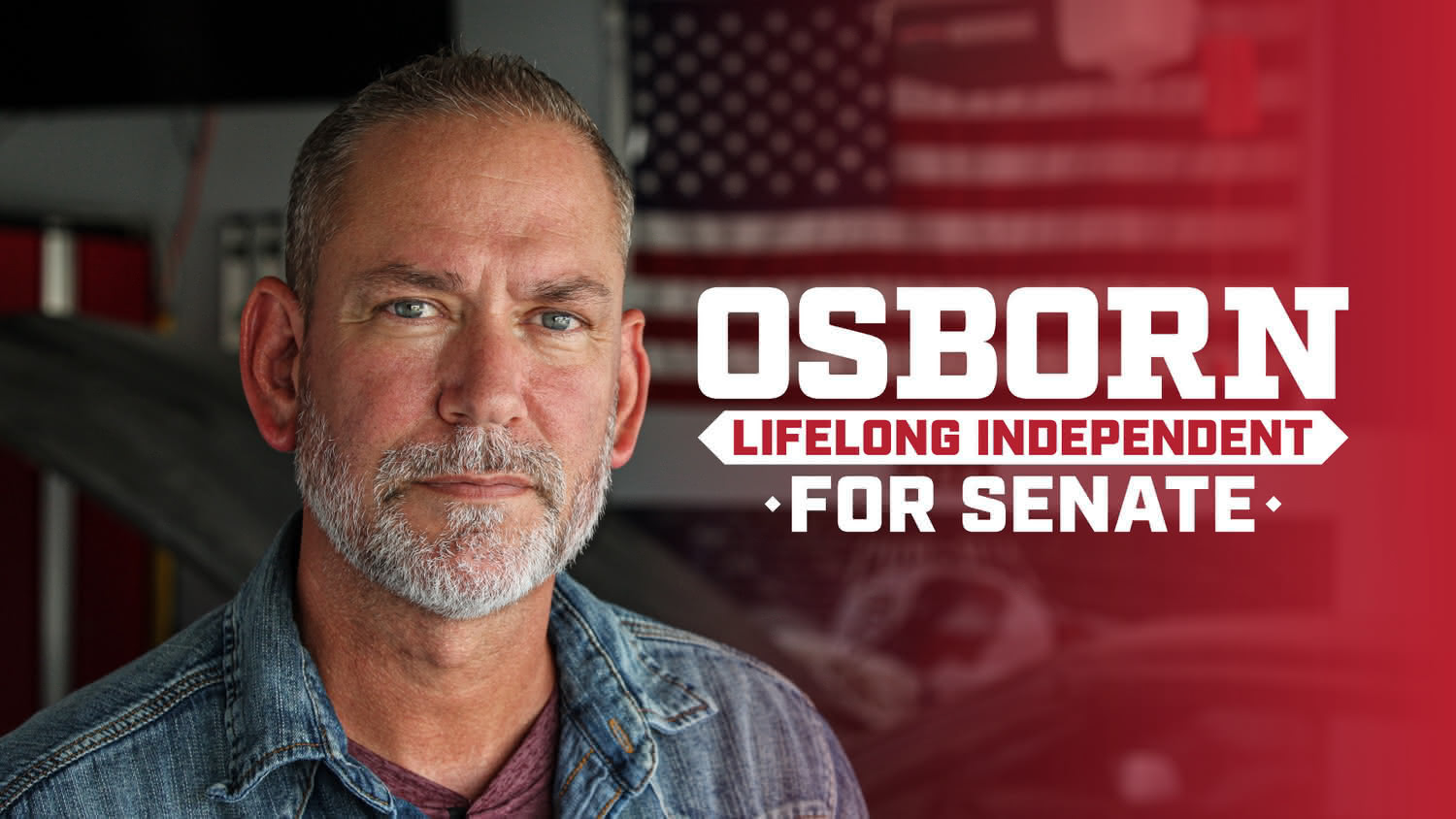

This is Endorsement #9 — for Dan Osborn, running for U.S. Senate in Nebraska.

This one is a little different for me: Osborn is more ideologically moderate than some of my other endorsements, but still very clearly populist and working‑class — and I’m just as excited about this race because he can actually win statewide in Nebraska.

With Osborn in the Senate, you could count on his vote for a lot of core populist, pro‑worker legislation, even if we will not agree on every single issue.

Frankly, this is one of the most exciting campaigns this cycle - and can really give us a strong showing that is pro worker in November.

Why this endorsement

- Winnable populist lane. A real shot at flipping a Senate seat with a candidate who still speaks to working people and corporate power.

- Reliable ally on big fights. Someone you can realistically see voting the right way on many major populist priorities.

If that combination — win the seat + move populist legislation — resonates with you, consider chipping in above.

04 Dec 2025 Reading time: 1 minute Quick spotlight on a group that turns legal expertise into real‑world impact.

What is Lawyers for Good Government?

Lawyers for Good Government (L4GG) is a community of 125,000+ lawyers, law students, and activists using pro bono work to protect equal rights, equal justice, and equal opportunity — from democracy and the rule of law to civil rights and climate justice.

Why I like recommending them

They leverage specialized skills at scale — one organization coordinating thousands of pro bono hours where they matter most.

How to support

Donate — Lawyers for Good Government Read their mission & principles

If you’re in the legal world, their pro bono projects are also worth a look.

Also see other entries in the series:

02 Dec 2025 Reading time: 1 minute Quick spotlight on a group doing vital, concrete work for trans people.

What is Trans Lifeline?

Trans Lifeline is a peer‑run hotline and microgrants nonprofit for trans people.

- Hotline: confidential peer support from trans operators

- Microgrants: help with ID changes and basic survival costs

Why I like recommending them

- By and for trans people.

- Material help, not just talk.

How to support

Donate — Trans Lifeline

Monthly gifts help keep the hotline staffed and microgrants available.

If you or someone you know needs it

01 Dec 2025 Reading time: 30 seconds

This is Endorsement #8 — for Kat Abughazaleh, running for Congress in Illinois’ Ninth District.

Her core line: Democrats need to do more to stop Trump and fight for working people.

Why this endorsement

- Working‑class focus. Frames the race around working people, not donors.

- Real primary contrast. Presses Democrats to confront Trumpism and the billionaire status quo.

If this matches your politics, chip in or volunteer.