Stunningly Bad Numbers Spell 'Bad News Bears' for Trump’s Economy & Approval

05 Mar 2025 Reading time: 7 minutes

A few major sets of data have dropped recently, showing that the new administration’s aggressive policies and rhetoric are both not resonating with Americans and causing significant economic pain.

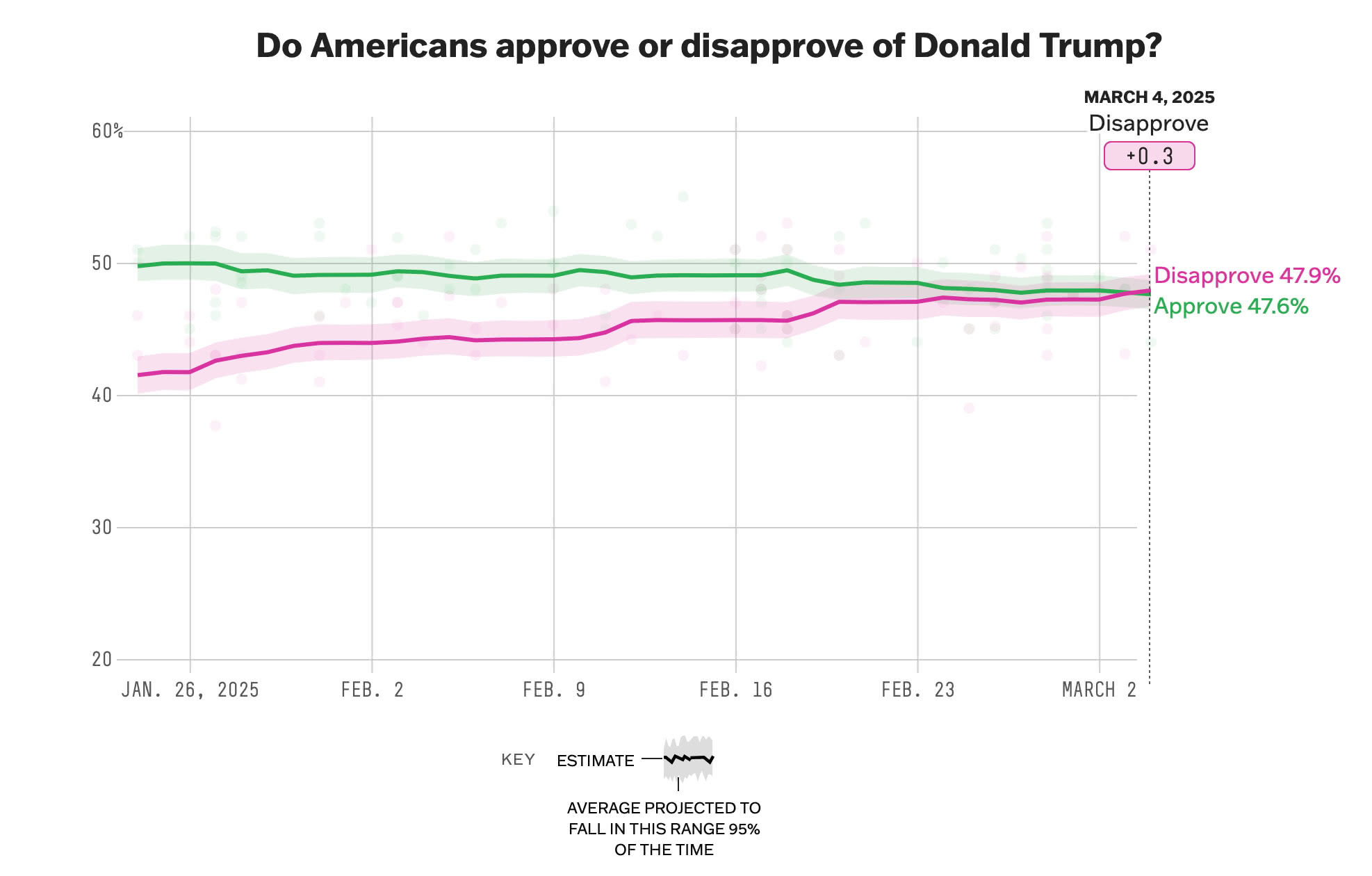

Remember, Presidents usually start with a high to very high approval rating as they enjoy a honeymoon period while they start their term. Historically, many people who did not vote for a President give them a thumbs up during this period. In the polling aggregate 538 - Trump has never had above 50% approval so far in his second term; historically bad starting point (with the recent exception of Trump’s first term).

UPDATE: ABC has shutdown 538 to save on costs. Shortly after - a very similar aggregate site showed the move into net disapproval: VoteHug Polls. Interestingly, the movement is more dramatic from the start of the term until now.

If you’re unfamiliar with the 538 polling aggregate - it pulls in many polls and averages them based on ratings. It even includes many Republican funded polls.

While it was not particularly good for a newly elected President, he still enjoyed a relatively decent net approval average of +8.2 (approve - disapprove) at the beginning of the second term.

Net Approval Hits Negative

As of March 4th, his positive approval has turned to disapproval for the first time during the second term to +0.3 disapprove - less than 2 months since the inauguration.

This is a dramatic fall - and again, from +8.2 approval to +0.3 disapproval in this time is not normal, but in this case - observing the approach so far definitely tracks with large polling number decreases.

I will talk more about economic indicators later - but by the way - this is all before the largest impacts from the negative policies have hit Americans, it’s only just started. These numbers do not even take into account the tariffs that were put into place today. Inflation, economic slowdown, consumer sentiment - all are showing negative data already, fast, and will continue & escalate if these policies are not reversed and/or not pursued.

Does It Matter?

Yes – emphatically yes. Not only are members of Congress facing increasingly hostile town halls (from both Republicans and Democrats) - approval ratings does affect policy in both executive and legislative branches - but especially the latter. Of course, it is not going to completely change policy, but it does have an impact. Additionally, as the approval goes down - the benefit of loyalty to the administration by members of the GOP decreases; we’ve seen this in practice before during the first term. It becomes harder and harder to get anything through Congress and/or not face material backlash. The 2026 midterms are not as far off as they seem.

Economic Data Rapidly Deteriorating

See previous articles describing what some of the policies are - and what I explain/predicted their impacts to be:

Tariffs

- Tariffs Part 1: An Introduction

- Tariffs Part 2: An Impossible Balance

- Tariffs Part 3: Foreign Relations, Reactions, and Retaliations

My Economic Prediction (from Jan 19th)

What you’ll see in the numbers below is the beginning of what I predicted in my 2025 Economic Predictions and Tariffs: Part 2 article (see above for both).

GDP estimates

A Federal Reserve Bank (non-partisan) - has changed their GDP forecast for Q1 2025 from a high of +3.9% to -2.8% — a 6.8% swing. I can not overstate how awful this is, and how quickly the threatening and implementation of tariffs, deportations, removing labor, and cutting of subsidies and other government spending - are impacting the whole economy. Additionally, and generally, chaos & bullying others as a governing strategy does not instill confidence in consumers and businesses.

Aggressive recession red flag, if GDP actually retracts to this extent - it’s all but a certainty recession will hit - and the jobs numbers will be very rough, very soon.

Checkout the release here.

Consumer Sentiment

“… consumer sentiment for the US was revised sharply lower to 64.7 in February 2025 from a preliminary of 67.8”

On February, 21st - consumer sentiment slipped to 64.7 —- the lowest in over a year. This is not a surprise - especially as tariffs continue to increase and more are threatened. I wouldn’t be shocked if we dropped to ~60 or lower by the time the next report is released March 14th.

“The decrease in sentiment was unanimous across groups by age, income, and wealth. The drop was led by a 19% plunge in buying conditions for durables, in large part due to fears that tariff-induced price increases are imminent. Expectations for personal finances and the short-run economic outlook both declined almost 10%, while the long-run economic outlook fell back about 6% to its lowest reading since November 2023. Meanwhile, inflation expectations for the year-ahead soared to 4.3%, the highest since November 2023. The five-year outlook increased to 3.5% from a preliminary of 3.3% and above 3.2% in January, the largest mom increase seen since May 2021.”

Ipsos Consumer Tracker

On February 28th - Ipsos released their survey data:

“The latest wave of the Ipsos Consumer Tracker finds that just 37% of Americans are comfortable with their personal economic situation today, a 14-point decline from November 2024. While all age groups show significant declines, those ages 55+ show the sharpest drop-off….”

We will talk more about inflation in a bit but check this out:

“Along these lines, Americans also report seeing higher prices for things they have paid for in recent weeks. At least seven in ten say prices are higher now than they were this time last year for dairy (82%), their total grocery bill (81%), food at restaurants (73%), meat (72%), and fresh fruit/vegetables (71%).”

Staggering.

Price Increases

There are many causes of inflation (in reality, we are talking about price increases) - supply and demand side of goods/services and of money. A lot of the inflation we saw after the pandemic was primarily caused by supply chain disruptions.

One other way to increase prices of goods for people is to raise taxes on the goods - which is what a tariff is. For more information on Tariffs - see my Tariffs Series.

Not only that - threatening them causes pricing increases by front loading demand, businesses preemptively raising prices to cover potential expenses, etc.

The latest CPI (Consumer Price Index) came in at a 3.0% increase. Source.

Small aside

By the way - check out the uncertainty index - its quite stunning. Uncertainty is as high as it during recessions.

Conclusion

It is very concerning that we are seeing signs of major demand softening (as tracked by both Consumer Sentiment and negative GDP estimates) - while seeing inflation continue to rise. This is a very nasty situation I described in my 2025 Economic Thoughts & Predictions (before all of this data came out!!!!) - stagflation & recession likely.

What’s especially amazing about the economic numbers is that this is fully self inflicted, it did not have to happen - but all Americans are (and will continue) paying the price. People are not going to continue to tolerate this level of self inflicted harm for long as it hits them in their

What’s Next?

Unless policy changes drastically, or a miracle occurs - we will continue to see all of these numbers get worse and worse.

I will also be looking with great interest at the jobs numbers – another major red flag would be if those massively miss expectations - or god forbid they’re negative.

Other Articles That Help Explain Why This Is Happening

Some other articles you can use to help explain directly or indirectly why these policies lead to these outcomes: